Are You Getting a Marine Fuel Tax Refund For Your Boat Fuel?

Clint

You might be eligible to save a lot of money with a marine fuel tax refund...

Every state has fuel taxes. Most of the money that states raise from fuel taxes goes to repair road damage caused by vehicle damage.

Your boat takes gasoline, but chances are you drive your boat on water, not asphalt (we hope). Thankfully, many states recognize this distinction and offer recreational boaters a full or partial refund on the fuel taxes they pay each year. After all, it’s not fair for a boater to pay a tax designed to pay for road damage caused by automobiles. States that offer marine tax refunds include:

- Alaska

- California

- Connecticut

- Delaware

- Massachusetts

- Missouri

- Nebraska

- North Carolina

- Texas

- Virginia

- Washington

- Wyoming

If you live in one of these states and you want instructions about how to apply for a marine fuel tax refund, visit: //www.americanboating.org/fueltax.asp. States that do NOT offer a marine fuel tax refund usually put the tax revenues from marine fuel taxes into various boating programs through the Aquatic Resources Trust Fund.

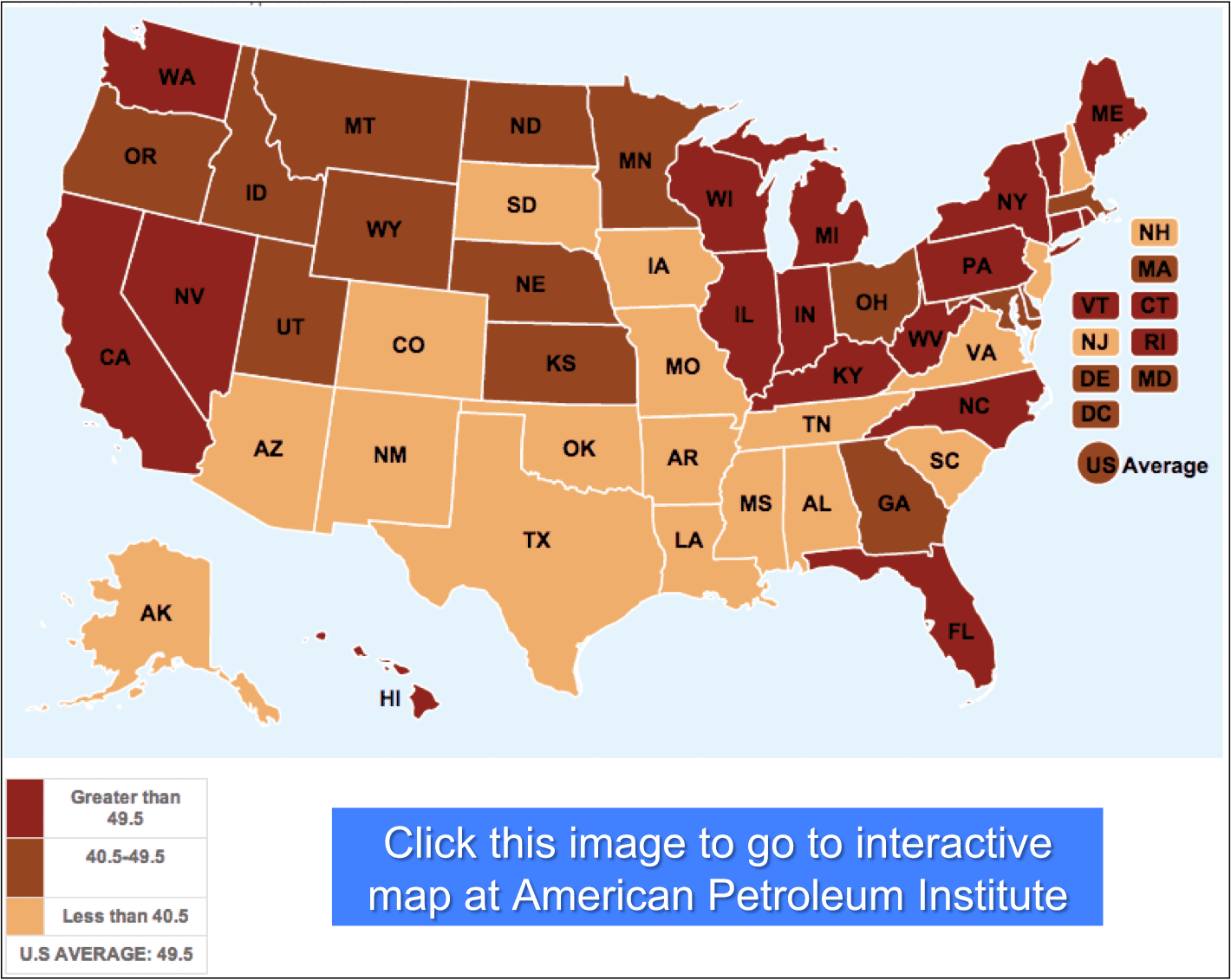

Fuel Taxes By State

What’s the fuel tax in your state? Click on the image below to go to an easy-to-use interactive tax map from the American Petroleum Institute:

As you’ll see from API’s interactive map, the total state taxes per gallon varies widely by state. The lowest state fuel tax is Alaska at $0.08/gallon. The highest state fuel tax is California at $0.54/gallon.

So, depending on how much you use your boat and what state you live in, you might be eligible to get quite a bit of money back at tax time through your state’s marine fuel tax refund!

Happy Boating from Boat Covers Direct!